Results

In 2021-2022, we partnered with Neighborhood Housing Services of Baltimore (NHS Baltimore) to pilot our tech-enabled financial coaching program.

221

Participants

99

Attained mortgage readiness

41

Purchased homes

99 Clients attained mortgage readiness creating

$19.2

MILLION

In mortgage purchasing power

2.8 months

in Program

2 hours

With Coaches

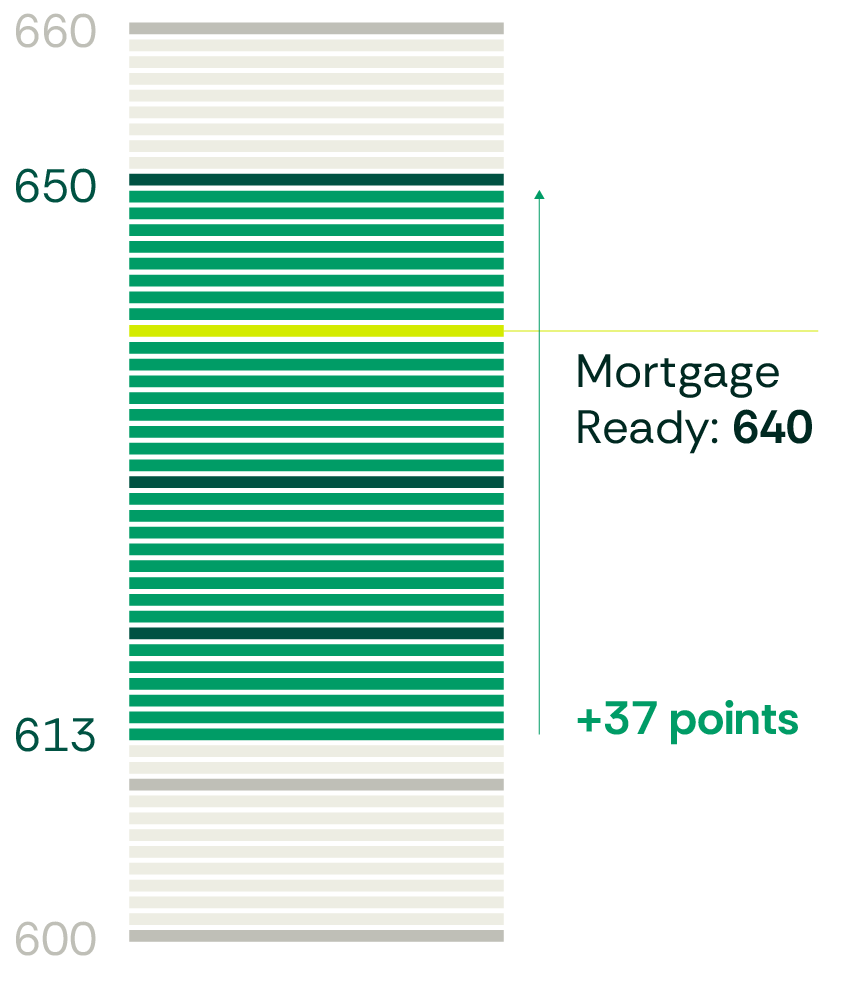

Credit

Program graduates increased credit scores by an average of 37 points.

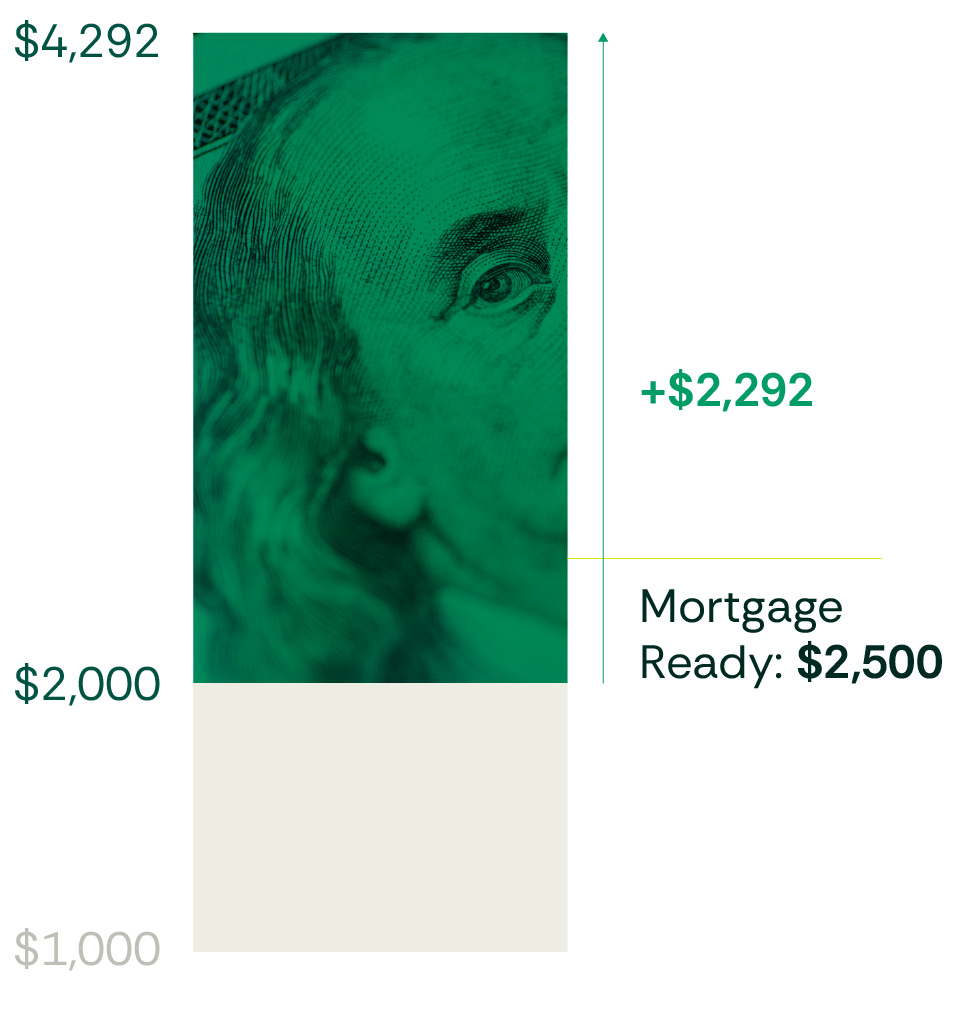

Savings

Program graduates saved an average of $2,292 towards down payment and closing costs.

Theory of Change

-

Number of participants served

Who we serve

Participant touchpoints

Program model fidelity

Participant satisfaction

Program sustainability:

- Cost-effectiveness in service delivery

- Aligned financial incentives for 3rd-party payers

-

Pay off collections

Lower credit card balances

Decrease spending/costs

Correct credit report

Set a monthly savings goal

Open a secured credit card

Avoid late payments

Establish credit (thin file)

Strategic refinancing

-

Credit score increase

Savings increase (through decreased spending)

Monthly debt obligations decrease (through principal payment or interest rate reduction)

-

Mortgage readiness

Participant satisfaction with homeownership decision

Informed and successful home purchases

-

Wealth accumulation and intergenerational transfer

Join our mailing list

Sign up with your email address to receive news and updates.